Do You Need a Survey?

Purchasers need to do their own inspection.

People who expect to purchase a new home are faced with many unfamiliar tasks. Their real estate broker helps them to understand and to do most of the tasks. The problem with inspection is that the issues are mostly facts that are not known combined with complex real estate law. Most real estate brokers will not be able to assist the purchasers to understand how to determine the likely boundaries, or how to determine the area burdened by easements. Very few real estate brokers are also real estate lawyers, so the purchaser will not understand the laws that apply to adverse possession that are most important to evaluate the boundaries.

It is certainly true that most residential purchasers in our Puget Sound area do not require a real property lawyer. Real estate brokers are well trained to use very refined standard Purchase and Sale Agreement forms. The standard of care of escrow agents is very high. Limited Practice Officers employed by escrow agents are licensed by the Washington State Bar Ass’n and well trained how to select and prepare typical real estate documents, such as the deed. Residential lenders are highly regulated with Federal and State statutes requiring fair disclosures. None of those professionals are able to provide legal advice to a purchaser to assist their evaluation of the legal rights of the property owner and neighbors with respect to the boundaries, easement rights and burdens, or enforceability of covenants or restrictions.

It is very rare in our area for parties to a residential home sale to hire a surveyor. Sometimes the Purchaser needs to know before constructing new improvements. Usually an inspection is adequate to disclose possible issues adequately for a Purchaser’s needs.

Before we discuss how to inspect, we need to discuss why inspection of the land is so important.

The title report is limited in its disclosure about title matters. The title company does not inspect the land. The primary reason is that the title insurance policy provides almost no coverage that the boundary improvements are on the legal description boundary.

The title company only reports about recorded documents. Like an iceberg, only a portion of title matters are recorded and visible. The purpose of an inspection is for the purchaser to look for unrecorded matters that are legally enforceable rights to ownership and rights to use land as easements. Washington real property law gives priority to the actual possession and use on the land. Actual use can win against the descriptions in the recorded documents. Actual use can win when nothing is recorded.

Let’s look at how the title company handles those important rights based upon use, and what coverage a purchaser gets against those unrecorded rights based upon use. The basic standard coverage title insurance policy has a Covered Risk against loss due to encroachments, but does not apply if Schedule B exceptions take away that coverage.

- Any defect in or lien or encumbrance on the Title. This Covered Risk includes but is not limited to insurance against loss from … (c) Any encroachment, encumbrance, violation, variation, or adverse circumstance affecting the Title that would be disclosed by an accurate and complete land survey of the Land. The term ”encroachment” includes encroachments of existing improvements located on the Land onto adjoining land, and encroachments onto the Land of existing improvements located on adjoining land.

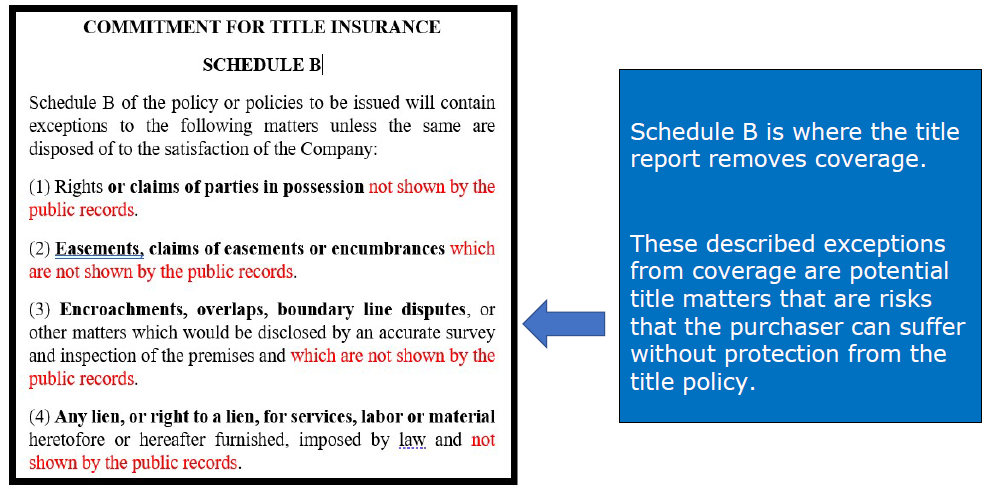

But look on Schedule B General Exceptions on the “title report,” which is the Commitment for Title Insurance, for these standard coverage exceptions from coverage:

What do those words mean?

(1). A claim of a “party in possession” is any type of interest in the land that the person now using that land might say if you had asked. The law says the purchaser is subject to whatever unrecorded rights that occupant might claim.

Three examples related to the entire property or related to a portion of the property:

- If the person living in the house is not the seller, that person might be a tenant with a long-term lease that is not recorded.

- The person might hold a valid but unrecorded deed from the seller.

- If a portion of the land described in the deed is actually on the neighbor’s side of a fence, the neighbor’s claim of ownership of that portion by adverse possession is a party in possession that is not shown by the public records.

(2). A claim of a right of easement can be based upon a use upon the land that a neighbor has used without permission for a period of at least ten years. Such easements are legally enforceable against a purchaser because their use is apparent upon inspection.

Two examples of easement claims based upon use by a neighbor:

- If there is a utility pole with wires going over the property to a neighbor’s home, that is an easement use by the neighbor that is not shown by the public records.

- If there is a paved road going across the property to a neighbor’s home, that is an easement used by the neighbor that is not shown by the public records.

(3). Matters that an accurate survey would disclose. Sellers in our area almost never will pay to have a survey done of the property to be sold. Most purchasers do not pay to have a survey done for a residential purchase. I do not think most people need to have a survey done.

Without a survey, a purchaser will not know if the boundary improvements, such as fences and rockeries, are on the legal boundary line. Very often, the improvements constructed by prior owners of the property are actually over the boundary, which are called “encroachments.”

If a survey had been done, it would discover an encroachment because the surveyor must locate all improvements and where they are with respect to the invisible line of the legal description on the recorded deeds.

Overlaps are legal descriptions that do not match with the neighboring legal description. In the history of development of the land, sometimes the subdivision uses inconsistent legal descriptions. A deed to a neighbor that was recorded first would be entitled to superior ownership. A surveyor is responsible to compare those descriptions.

(4). Mechanic’s Liens are lien rights that are given to those who perform work or provide materials upon real property. An inspection upon the property should disclose work done within the past 90 days. Many title companies remove this standard coverage exception for Homeowner’s policies. A purchaser that is assuming this risk should look for recent improvements, such as a new roof, new cabinets, a new furnace, and should ensure the seller pays for that work.

The title insurance policy with those standard coverage exceptions will not protect against loss due to these unrecorded matters, so the purchaser should carefully inspect the property looking for these title issues that are disclosed by the inspection of the actual uses by the owners of the property on both sides of boundaries.

The Homeowner’s Policy of Title Insurance provides limited, but valuable protection against some consequences related to encroachments. If you have that Homeowner’s coverage, it is less valuable to pay for a survey.

The Covered Risks of the Homeowner’s Policy include these three protections:

- You are forced to remove Your existing structures because they encroach onto Your neighbor’s land. If the encroaching structures are boundary walls or fences, the amount of Your insurance for this Covered Risk is subject to Your Deductible Amount [Probably $2,500 and Our Maximum Dollar Limit of Liability shown in Schedule A [Probably $5,000].

- You are forced to remove Your existing structures because they encroach onto an Easement or over a building set-back line, even if the Easement or building set-back line is excepted in Schedule B.

- Your neighbor builds any structures after the Policy Date — other than boundary walls or fences — which encroach onto the Land.

There is an important exception to the protection of any form of title insurance policy. This is important for a Purchaser to know about.

Paragraph 4 of Exclusions from Coverage:

In addition to the Exceptions in Schedule B, You are not insured against loss, costs, attorneys’ fees, and expenses resulting from: … 4. Risks: … b. that are Known to You at the Policy Date, but not to Us, unless they are recorded in the Public Records at the Policy Date;

If you discover a title problem that is not a recorded matter, you should disclose it to the title company! If you don’t, you will have no protection. If you do disclose it to the title company, they might add it as a Special Exception so you get no coverage for that matter. Often the title company will assume that risk, especially if that issue has existed for more than ten years based upon adverse possession principles. More likely than not, you will not know. Disclosure is not required if you do not know. During an inspection, I rarely know where the survey boundaries are. I often suspect there are boundary improvements that are encroaching, one side or the other, but I don’t know.

What if you hire a surveyor? One consequence is that you will know there are encroachments and you will be obligated to disclose to the title company. Usually they will add a special exception and remove all coverage. You can often persuade the title company to assume the limited coverage of the Homeowner’s Policy if that has existed for more than ten years.

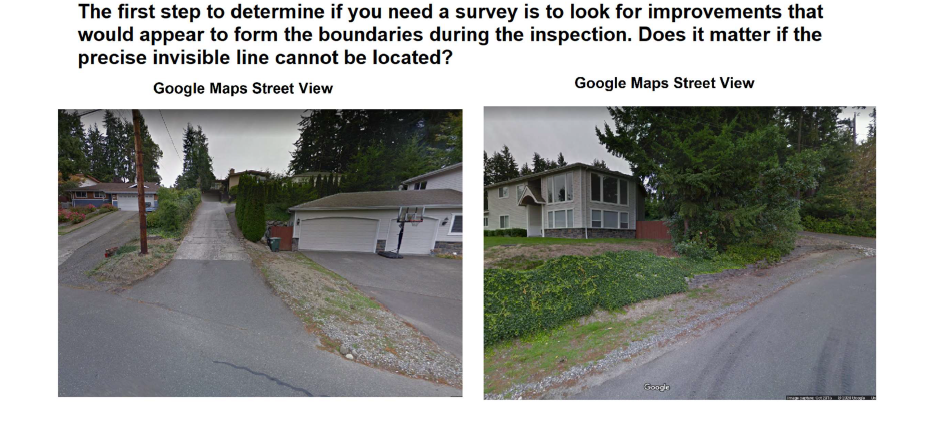

Example of an Inspection

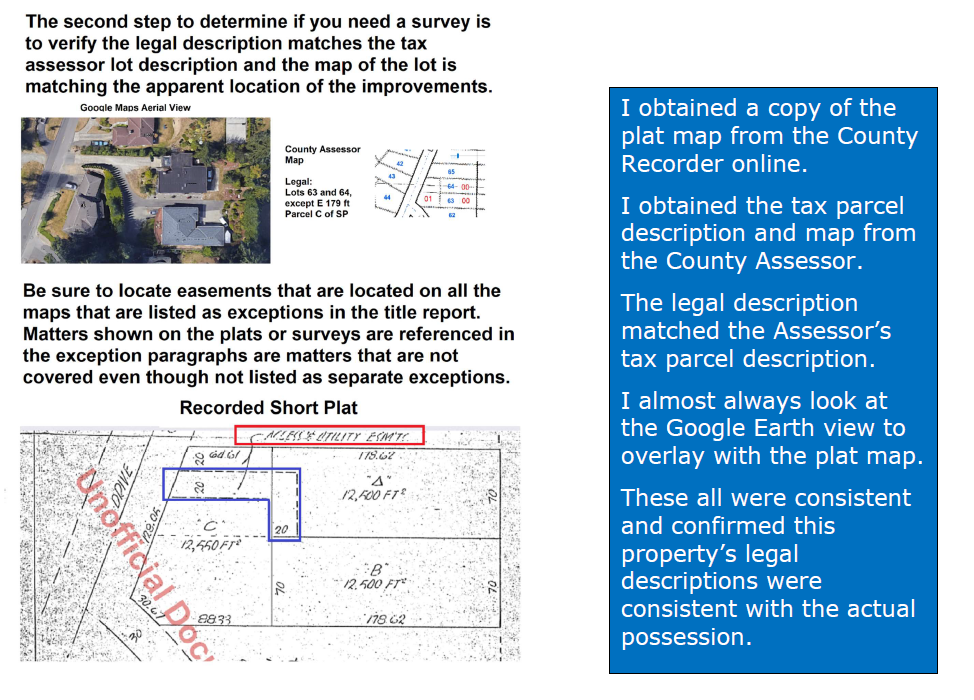

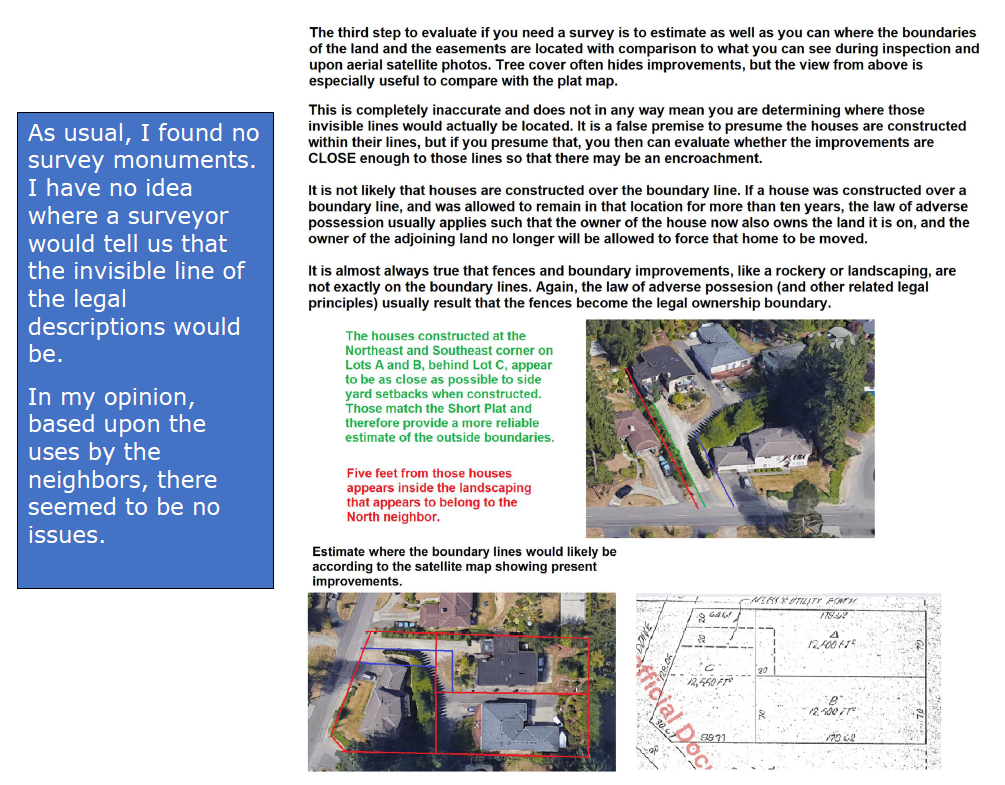

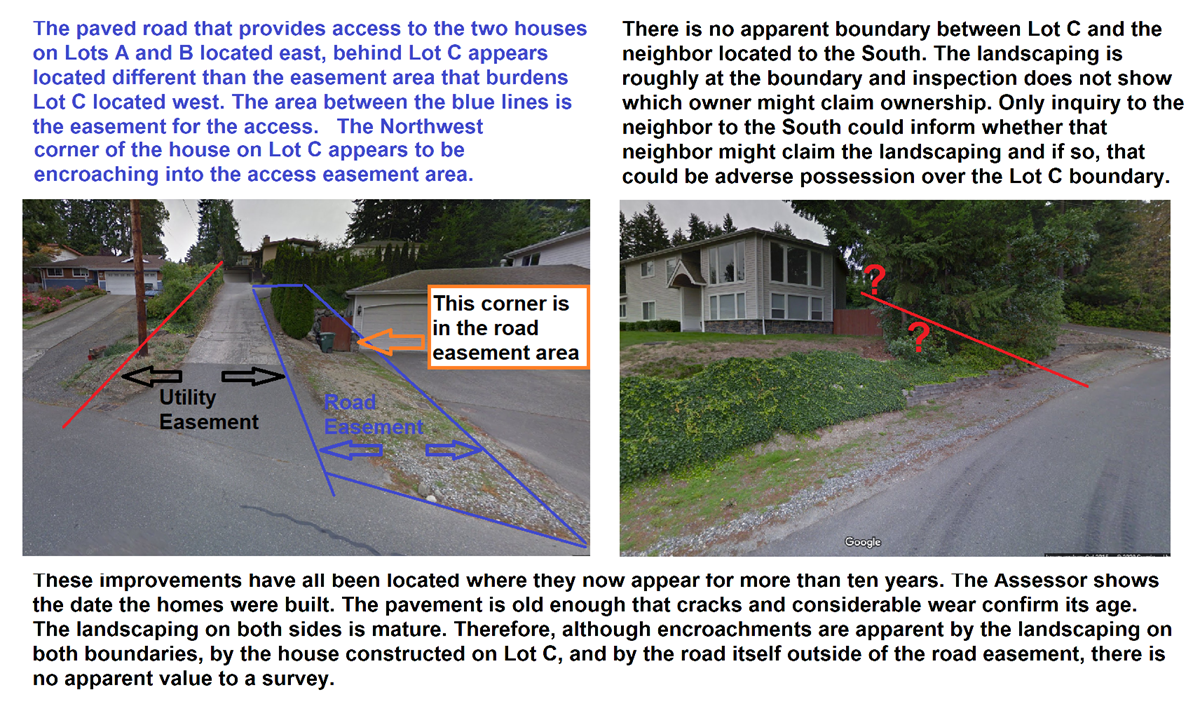

Last week I performed an inspection that revealed boundary landscaping that appeared not to be on the boundary line, and I believe the house was encroaching into the area that was supposed to be the access road. I also concluded that the neighbor’s road was encroaching onto the property, not where it was supposed to be located. However, I concluded there was no need for a survey to determine where the invisible lines were on the dirt.

This is what the property looked like:

Legal Conclusions and Advice:

The principles of adverse possession are extremely important when you evaluate the results of an inspection. However, there is no substitute for professional real property judgment. It is not possible to know if a Judge in the future boundary dispute will conclude that the prior use of the property by the owner of certain boundary improvements will satisfy all the elements that court decisions generally agree upon.

There are so many appellate court decisions, all with some variance in the facts. The result is that even lawyers familiar with the principles might disagree. Nevertheless, I generally can conclude whether boundary improvements have existed for ten years.

In this particular inspection, I did not know who put in the landscaping. I will not advise people that landscaping represents boundary improvements that entitle the owners on either side to claim adverse possession. This was an example of that.

If the Purchaser needs more certainty, it is always best to simply ask the neighbor. Whose shrubbery is this? Do you know who built the rockery? Where do you think the boundary is located? Generally I do not do that, but I advise Purchasers they should not presume these are on their side of the line, and ask if they would care.

Looking at the neighbor’s road, I concluded that the portion of the road that was upon the land being inspected had been there long enough that the owner would not expect to obtain court enforcement to move the road. The users of that road either had a prescriptive easement or perhaps had established ownership by adverse possession.

The likely encroachment of the house onto the area for the road easement is not likely to be a serious title problem. The road was located elsewhere, apparently abandoning the stated easement area.

The owner of that house would be entitled to adverse possession ownership where the house is located, and a reasonable setback too. But even if the house had been built within ten years, the easement user would not be entitled to force the house to be moved. Courts would require the owner to pay damages, but would not require the huge cost of moving the house.

Lastly, and always important in my advice whether a survey is needed, is whether title insurance will protect against loss to the owner. Covered Risk 23 of the Homeowner’s Policy, quoted earlier, provides specific coverage, and its coverage is not limited. Only a specific exception in Schedule B specifying the possible house encroachment would avoid that coverage. I don’t know that house is encroaching. I would not advise the potential Purchaser to disclose the issue to the title company.

What would a survey accomplish in this example?

A surveyor cannot tell you where the legal boundaries are located. A surveyor can tell you precisely where the legal description boundary would be on the dirt. Surveyors do not make legal determinations related to adverse possession or prescriptive easements.

In this example, a surveyor would probably confirm all of my guesses. You still would not know who owned the particular landscaping. You still would not know whether the neighbors have established adverse possession rights.

The bottom line determination for a Purchaser is whether they accept these unknowns with the limited coverage available from the title insurance policy. I ask them, “if it turns out that your legal boundary is ten feet on the other side of the neighbor’s fence, would you care if that neighbor is entitled to adverse possession ownership?” Similarly, if it turns out that your boundary is ten feet on your side, and your neighbor forces you to move it, how would that affect your future use of the land? The title insurance will require a $2500 deductible, and will only pay $5000 maximum.”

All of the issues that I found would not entitle a Purchaser to cancel an existing Purchase and Sale Agreement. The Seller is obligated to provide “marketable title.” The agreement states “The following shall not cause the title to be unmarketable: … easements and encroachments, not materially affecting the value of or unduly interfering with Buyer’s reasonable use of the Property.”

There can be a way to get professional assistance from a surveyor without the huge cost of a full survey. A full survey sufficient for a title insurance company to provide extended coverage is $2000 minimum. The surveyor must establish monuments and make a drawing showing the location of all improvements and easements. I have never witnessed a seller paying for that. If you change the request, asking the surveyor to rely upon local monuments and simply stake the most likely, that is much less work, less liability for the surveyor, and less expensive. The surveyor still cannot tell you where the legal ownership boundaries are located.

** DISCLAIMER: No person should rely upon a blog article as legal advice applicable to their particular circumstances. Dwight is not acting as the attorney for anyone and no attorney-client relationship exists. This is only to provide general education about the principles and typical practices within the local the real estate industry. **